The Travel Industry is Cutting Costs with Back Office Automation

By David Eddy on Oct 22, 2015 7:00:00 AM

With continuing consolidation, intense competition and a global economy seemingly unable to break free from lackluster growth, there is relentless pressure on travel companies to discover new ways of: differentiating from competitors; marketing with better results; developing even more innovative services; and strengthening customer loyalty. Since all these endeavors cost money, smart companies begin by identifying and eliminating needless expenses. One of the overlooked places to uncover monetary – and productivity - leaks are manual workflow activities that can be optimized with back office automation.

For the purposes of this article, back office operations are those which are not customer-facing: e.g.: payroll, accounting, procurement and vendor management. Surprisingly, many travel companies often fail to give manual, back office, activities a hard look. There are two likely reasons for this: one, they misunderstand what’s meant by manual activities; two, if they do understand; they are unfamiliar with how to find them.

Manual activities do not refer to business activities conducted as if it the company was stuck in some pre-automation mode from the last century. Management making that mistake would read the last paragraph and say, “We’re running good accounting software and its payroll module hasn’t caused us a moment’s trouble. Not sure about procurement, but vendor management is fine – we get decent reports on revenues and margins by the tenth day of the next month.”

What manual activities do refer to are the continual work-arounds done by employees each week, month and quarter to get past bottlenecks caused – not by an absence of automation – but by data and workflow gaps between incompatible business process automation systems.

Take, for instance, the vendor performance reports cited in the prior paragraph. It’s likely that two or three people spend ten days between the close of books on the 5th, and report release on the 10th, running excel spreadsheets populated from various unrelated data sources. Further, it’s equally likely that work is so ingrained in office routine no one even thinks twice about it. Yet, just those manual activities – so seemingly minor as to be almost invisible - are costing the company at least $24,000 per year.

Finding Manual Activities in Back Office Operations

As we’ve just seen, a major challenge in finding costly manual activities in back office operations is often their familiarity. Since those activities exist to knit together various data  streams and workflows on a regularly scheduled basis, they are completely embedded in the operational routine. In order to find them, management needs to know where to look.

streams and workflows on a regularly scheduled basis, they are completely embedded in the operational routine. In order to find them, management needs to know where to look.

1. Lagging and Inflexible Account Performance Reporting: allocating revenues by account is a relatively easy task for any reputable accounting system: costs, however, are usually another matter altogether. For example, the cost of sales for corporate accounts is heavily influenced by skillsets and effort requirements. How many monthly man hours are consumed by the account? What combination of senior or junior talent was required to generate the prior month’s revenue; what were the actual payroll costs? If this data must be manually captured in spreadsheets, accurate reporting of the true cost and profitability of an individual account will be a complex, time-consuming and error-prone activity.

2. Slow (or no) Adoption of BI-related Travel Account Services: a corollary to the prior point, successful travel management companies now offer their corporate accounts BI-related services that identify areas of untapped savings opportunities. Moving beyond basic reports, a progressive travel management company (TMC) will use BI analytics to pull meaning from many data sources, making the client aware of travel patterns and travel policy compliance gaps which can be addressed to cut their travel costs. Up against this level of service, the cost to travel companies with unintegrated applications soars beyond manual labor expense and into the much more significant realm of non-competitiveness and lost revenue.

3. Delayed or Lost Residual Ticket Value: corporate travel often incurs frequent changes to travel plans and associated re-issued or refunded tickets. Quick and accurate reconciliations of ARC/BSP reports are essential for timely recognition and reporting, capture by accounting and use of residual ticket value in future travel. These ticket values are in the scope of standard monthly account reports to the client and consistent lag times in value recognition and use will damage the account relationship. In such circumstances, management should immediately focus on the extent of manual activities within the reconciliation process and arrive at a mitigation strategy.

4. Debit Memos -Slow Resolution and/or Unallocated: debits memos are triggered for reasons as minor as missing data or as expensive as violating ticket pricing use requirements. Usually several people are involved in the research and resolution of the debit memo. Consistently slow resolution times are indicative of manual activities: people relying on hand-carried distribution through the office; confusing hand-written documentation and unreported bottlenecks. Further, if the debit memo requires payment, manual activities may not place the expense into the accounting system for a charge-back allocation to the appropriate client.

5. Service Supplier Commissions: calculating outstanding commissions from service suppliers such as hotels and car agencies; reconciling payments against outstanding commissions and collecting any shortfalls is a major unautomated activity for many travel companies. A manual approach is often used because a sophisticated enterprise resource planning system is required to: utilize algorithms for arriving at outstanding commissions; apply payments to the proper accounts; trigger any internal commissions in the payroll system, and notify accounts of remaining delinquent accounts.

Management should look closely at the expense and effectiveness of any manual activities in this commission area. Certainly one reason is to reduce expenses wherever possible. But a larger reason has to do with future growth. If this process is primarily manual, the larger cost to the company may well be lack of scalability.

For example, investment in services and products may lead to a reasonable forecast of 15% annual growth over the next five years. But a reliance on a manual commission process could lead to an unmanageable workload, and erosion in account margins, if the manual process cannot match operational growth with its own equally strong increase in productivity.

Automating Back Office Operations with ERP

An enterprise resource planning system has the capability to deliver an integrated suite of applications for front office, mid-office and back office business processes. The heart of the system's value proposition is a common data model and standardized processes across such  primary software applications as: accounting, payroll; HR; supply chain, CRM & procurement.

primary software applications as: accounting, payroll; HR; supply chain, CRM & procurement.

Since their emergence in the 90’s, these enterprise resource planning systems have evolved from monolithic, costly to customize, implementations into smaller, nimbler systems targeted at specific industries: the travel industry being a case in point. These systems are aimed at small to mid-sized companies, both in terms of range of functionality and also investment cost.

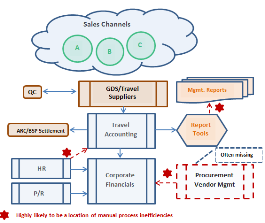

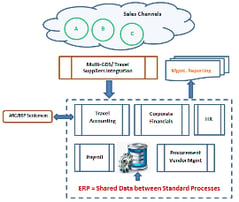

The two graphics in this blog show the high level distinction between (first graphic) a non-integrated group of applications, typically acquired independently and over time, with an (second graphic) enterprise resource planning suite of travel-specific applications designed to work smoothly and interchangeably with each other.

The non-integrated graphic shows the three most likely areas of significant manual activity – reporting; porting payroll information into the travel accounting systems, and procurement/vendor management. The prior example of complexities in commission reconciliation and collection show why many travel companies have little or no software functionality in the procurement/vendor management area at all.

The most important values these systems bring to travel automation is a common data model and standardized processes, because it is lack of one or both that drives the majority of manual activities in non-integrated systems. With common data structures, information can be designed for use once and updated with minor tweaks going forward; reporting becomes quick and flexible; BI is a reality and a competitive weapon. With standard processes, structured data can flow in a smooth automated workflow from one application to another: for example, payroll into account costing.

The most important action for Travel management to take is a hard look at manual activities, then endeavor to place a reasonable estimate on their direct and indirect (i.e. loss of revenue, competitiveness or both) costs. This information will be needed for a proper ROI-based decision for an automation investment. Too often travel management underestimate the cost of their manual work and overestimate what an automated back office solution could cost. The increasingly competitive nature of the travel industry calls for bold vision and objective decisions.

- travel technology (60)

- Travel Industry (49)

- travel agency (31)

- travel erp (31)

- travel trends (28)

- travel booking system (23)

- TINA (21)

- travel company (19)

- Tour Operator (18)

- Product updates (17)

- Travel Management Company (17)

- AIDA (15)

- TBS (15)

- Business Travel (14)

- dcs plus news (14)

- tour operator solution (14)

- travel website (14)

- travel erp system (13)

- Mobile App (12)

- Travel App (12)

- mid back office solution (12)

- trends (12)

- Corporate Travel (11)

- Industry Events (11)

- Mobile Technology (11)

- TMC (11)

- travel agents (11)

- erp (10)

- erp system (10)

- Tour Operators (9)

- Travel booking engines (9)

- dcs plus (9)

- online travel agency (9)

- travel agent (9)

- Mobile Bookings (8)

- travel (8)

- travel agencies (8)

- 2017 (7)

- Business Traveler (7)

- Mobile Travel (7)

- travel business (7)

- travel software (7)

- Digital Technology (6)

- Insider (6)

- Millennials (6)

- Online booking systems (6)

- Travel Management Companies (6)

- process automation (6)

- travel companies (6)

- Big Data (5)

- Partners interviews (5)

- Tour Operator Software (5)

- customer retention (5)

- travel agency technology (5)

- Booking engines (4)

- CSBT (4)

- Mobile Device (4)

- Mobile travel apps (4)

- OTAs (4)

- Static databases (4)

- Tour Companies (4)

- Travel Policy (4)

- Travel booking systems (4)

- Travel suppliers (4)

- back office automation (4)

- corporate self booking tool (4)

- millennial travelers (4)

- online travel (4)

- responsive travel website (4)

- technology (4)

- travel website conversion (4)

- 2016 (3)

- Content mapping (3)

- Databases (3)

- Demographics (3)

- Food and Adventure Tourism (3)

- Mobile Apps (3)

- Travel Distribution Channels (3)

- Travel Management Software (3)

- Travel customers (3)

- Travel history (3)

- anniversary (3)

- automated processes (3)

- content matching (3)

- global travel industry (3)

- social media (3)

- travel agency workflow (3)

- travel back office (3)

- travel marketing (3)

- travel process automation (3)

- AI in travel (2)

- Advanced Booking Systems (2)

- B2B Travel Resellers (2)

- Bleisure (2)

- Branding (2)

- Business Process Automation (2)

- Business Travelers (2)

- Customer engagement (2)

- Financial Reporting (2)

- Food Tourism (2)

- Inbound Marketing (2)

- Infographic (2)

- Leisure Travel (2)

- Saas (2)

- Templates (2)

- Travel Costs (2)

- Travel bookings (2)

- Travel start-up (2)

- Travel website abandonment (2)

- WTM 2016 (2)

- abandoned travel bookings (2)

- engagement marketing (2)

- internet booking engine (2)

- millennial traveler (2)

- new travel company (2)

- office (2)

- online reputation management (2)

- online travel reviews (2)

- reporting (2)

- software (2)

- start-up tips (2)

- travel agency management (2)

- travel agency website (2)

- travel experience (2)

- travel mobile app (2)

- travel packages (2)

- travel reservation system (2)

- travel system (2)

- travelers (2)

- web-based travel erp (2)

- 2020 (1)

- 360 Customer View (1)

- Advanced Accommodation Contract Management (1)

- Adventure travelers (1)

- Apps (1)

- B2B Reseller (1)

- B2B Resellers (1)

- B2C (1)

- BI Reporting (1)

- Budget traveler (1)

- Cancellations (1)

- Chat (1)

- Chinese millennial (1)

- Cloud (1)

- Cognitive computing (1)

- Comparison shopping (1)

- Conference (1)

- Contact matching (1)

- Content (1)

- Cruise (1)

- Culinary traveler (1)

- Customer relations (1)

- Digital Innovation (1)

- Digital Natives (1)

- Documents (1)

- Emerging market travelers (1)

- Emerging markets (1)

- Errors (1)

- Experimental travel (1)

- Financial Dashboard (1)

- Import rates (1)

- Instant messaging (1)

- Integrate with Accounting Software (1)

- Internet (1)

- Luxury traveler (1)

- Mobile Transaction (1)

- Mobile payments (1)

- NDC distribution (1)

- Operational Reporting (1)

- Reseller networks (1)

- Resellers (1)

- Response (1)

- Subagents Network (1)

- TINA Academy (1)

- TTE (1)

- Travel Reseller Network (1)

- Travel Revenue Management (1)

- Travel booking problems (1)

- Travel finance reporting (1)

- Travel stats (1)

- WTM (1)

- abandonment (1)

- accomodations (1)

- advanced reporting (1)

- airline direct connect technology (1)

- ancillary services (1)

- cloud computing (1)

- collection (1)

- collection challenges (1)

- common data model (1)

- conversion rates (1)

- corporate mobile app (1)

- cost control (1)

- credo ventures capital invests in dcs plus (1)

- customer reviews (1)

- data analysis (1)

- dcs plus credo investment (1)

- dcs plus credo ventures (1)

- deloitte technology fast 500 EMEA (1)

- digital transformation (1)

- e-invoicing KSA (1)

- email marketing (1)

- email marketing for OTAs (1)

- erp e-invoicing (1)

- lost travel bookings (1)

- modern travel agencies (1)

- networks (1)

- new features (1)

- offers (1)

- online customer review (1)

- online reputation (1)

- online travel agencies (1)

- risk management (1)

- sales (1)

- senior travelers (1)

- shopping baskets (1)

- shopping carts (1)

- social network (1)

- standardized processes (1)

- static content (1)

- travel SaaS (1)

- travel account services (1)

- travel agency customers (1)

- travel agency profitability (1)

- travel analytics (1)

- travel blog (1)

- travel planning (1)

- travel reviews (1)

- travel shopping carts (1)

- travel software for agencies (1)

- travel software system (1)

- travel technology europe (1)

- travlist smart mobile app (1)

- trend (1)

- trusted adviser (1)

- trusted advisor (1)

- upsell functionality (1)

- vouchers (1)

- website traffic (1)

- zatca (1)

Subscribe by email

You May Also Like

These Related Stories

Compelling Reasons to look for a Cloud-based ERP Travel Industry Solution

Is your Travel Technology ready for 2016 – or 2006?

No Comments Yet

Let us know what you think