Three Types of Reports – every Travel Company Needs

By David Eddy on Mar 22, 2016 7:00:00 AM

This week I was on a software provider's website and read this description of an ERP product feature, “With FeatureABC, the accuracy, the reliability and the availability of informa tion are improved so management can make better strategic decisions more quickly. Consolidation is beneficial in many processes in an agency.”

tion are improved so management can make better strategic decisions more quickly. Consolidation is beneficial in many processes in an agency.”

At first, I found myself thinking, “What are they talking about? What does this mashup of adjectives even mean?” Then I thought, “How many people in the travel industry even know what reports they need, much less what reasonable expectations should be for their reporting tools and database?”

With those questions ringing in my ears, I decided the point of this blog would be to walk through the essential reports every manager needs, touching on the value and benefits those reports should be delivering to him.

Three Essential Reporting Types

The three essential management reports are financial, operational and BI. Strictly speaking the only one that’s essential is the financial report. Why? Because it’s the basis of the company’s annual tax return and I don’t know of any government who views its tax revenue as something optional. But the other two aren’t essential only in the sense it also isn’t absolutely essential to run your business during the day rather than night. You’re free to operate only at night, but it gives the competition an overwhelming advantage. It’s the same with operational and BI reports: not having them isn’t against any law, but it will put your company at a huge disadvantage.

Question: can you stop reading, close your eyes and articulate what each of the three reports does and why they’re uniquely valuable? Let’s take a look.

Financial Reporting: often referred to as “Financial Statements”, this report contains a company’s cash flow statement, income statement, balance sheet and shareholder’s equity. Shareholder’s equity is out of scope because it relates to liquidated value and of little relevance to this discussion.

- Cash Flow Statement: this is #1 because bills and debt are only settled with cash – not profits. Ever had a bank balance shock after a good sales week? That’s because sales cycles and cash cycles are very different. This statement shows the sources and amounts of cash coming into the company, and the uses and amounts of cash leaving the company: hopefully the former is always greater than the latter. This is your company’s blood pressure – it’s vital this statement is detailed and easy to read.

- Income Statement: also called the “Profit & Loss (P&L) Report”, this report reveals if the company was able to generate a profit; i.e. did the amount of sales exceed the amount of expenses? Since some expenses are non-cash (accruals & amortization) it rarely matches the cash flow statement. For this report it’s vital all company lines of business have their own income statement. That level of detail is necessary for management to see what business areas are contributing to profitability and which are bleeding it.

- Balance Sheet: the balance sheet is often neglected by management on a monthly basis and looked at more closely on a quarterly, semi-annual and annual basis. Why? Because it doesn’t include operating results, only assets (cash, accounts receivable, equipment, buildings, etc.) and offsetting liabilities (accounts payable, short & long term debt, etc.). This report should always clearly show the company’s breathing room between quickly available cash and bills/loans coming due in the near future – and management should pay attention to it.

Operational Reporting: the purpose of these reports is to provide management with information on the company’s current operational efficiency. Using the analogy of a sail boat, they tell the captain the vessel’s immediate position, course and speed – plus whether water is rising or falling in the hold. Effective operational reporting should: enable management to analyze current and projected financial outcomes – and take immediate action to seize opportunities or cut losses; produce granular, performance outcomes on a daily basis. Examples include: profit margins on proposed & closed sales; available room inventory; activity at every stage of the sales funnel. A travel ERP operational reporting system should cover the following scope:

- Real-time Information: management should be acting in the morning on yesterday afternoon’s information and in the afternoon on what took place in the morning.

- Granular Reporting: real-time information falls short if it requires lengthy drill-down exercises. If sales margins are off, was in flights, hotels, tours or activities. Tours? Which tour company and what product?

- Flexible Ease-of-Use: an IT project shouldn’t be triggered if report users want a different view of data or type of analysis. They should be able to comfortably customize reporting with little or no assistance.

Business Intelligence (BI) Reporting: these reports have changed considerably over the past two years. Prior to then, the purpose of BI reports was to give management a much broader information perspective than operational reports by combining data from many sources: for example, other software systems (CRM, etc.), Point of Sale data, web apps and spreadsheets. Often the foundation for BI reporting was a data warehouse in which the structure of information from all these sources was standardized. However data warehouses are often not a practical option. For the travel industry a much more reasonable choice is the standardized data model which is part of a travel ERP system.

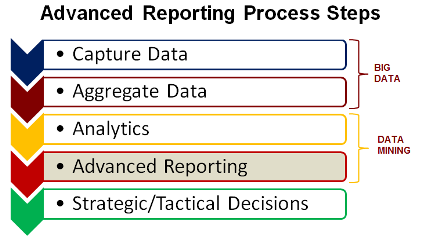

Within the past two years the terms “Big Data” and “Analytics” have been in the spotlight – and for good reason. These products can turn BI reporting into a much more effective tool for any travel company. For our purposes, “Big Data” is information purchased from a 3rd party (e.g. Google) in a structure compatible with a travel company’s data repository. “Analytics” are software tools that also integrate with the ERP system and extract information aggregated from all sources. For example, Gmail parsing (3rd party data) could reveal a number of repeat travel customers (CRM data) are also taking two and three day tours within driving distance of their homes – none of which is in sales (CRM data) history. Now travel agents have a new perspective on how to craft new travel values for them.

Excluding the added functionality of Big Data and Analytics (which could be beyond many budgets), BI reporting should provide the following value:

- Metrics & Measurement: leveraging data from many sources, BI reports should enable management to define key performance metrics, then measure and report them on a daily and weekly basis. Well-defined metrics should foreshadow operating results, giving clarity to why outcomes have occurred. They will also allow employees and management to stay on the same page in terms of high priority actions and what performance levels are necessary.

- Intuitive Transparency: BI reporting should take aggregated data from several sources and use graphics to illustrate trends and exceptions in a way so that meaning is easily grasped.

- Management Dashboards: BI report features should include an easily customizable management dashboard that provides “at a glance” functionality for a comprehensive view of company performance.

Some readers may have mentally checked off all three reporting types as they read through this blog. That’s great – just be sure your making the right level of demands on what’s being delivered to you each day, week and month.

It’s likely everyone was fine with financial reporting, and misses beyond the financials likely split disproportionally into the BI category. Missing either one will significantly affect competitiveness; missing both points to a serious weakness. However, the cure for both is the same: standardize data; aggregate information; extract with a robust reporting tool. A highly beneficial way to approach the cure is with a travel ERP system – it will not only accomplish all three activities, the system will also reduce costs by automating processes.

Dive into the travel industry! Explore useful insights and trends through our free eBooks now!

- travel technology (60)

- Travel Industry (49)

- travel agency (31)

- travel erp (31)

- travel trends (28)

- travel booking system (23)

- TINA (21)

- travel company (19)

- Tour Operator (18)

- Product updates (17)

- Travel Management Company (17)

- AIDA (15)

- TBS (15)

- Business Travel (14)

- dcs plus news (14)

- tour operator solution (14)

- travel website (14)

- travel erp system (13)

- Mobile App (12)

- Travel App (12)

- mid back office solution (12)

- trends (12)

- Corporate Travel (11)

- Industry Events (11)

- Mobile Technology (11)

- TMC (11)

- travel agents (11)

- erp (10)

- erp system (10)

- Tour Operators (9)

- Travel booking engines (9)

- dcs plus (9)

- online travel agency (9)

- travel agent (9)

- Mobile Bookings (8)

- travel (8)

- travel agencies (8)

- 2017 (7)

- Business Traveler (7)

- Mobile Travel (7)

- travel business (7)

- travel software (7)

- Digital Technology (6)

- Insider (6)

- Millennials (6)

- Online booking systems (6)

- Travel Management Companies (6)

- process automation (6)

- travel companies (6)

- Big Data (5)

- Partners interviews (5)

- Tour Operator Software (5)

- customer retention (5)

- travel agency technology (5)

- Booking engines (4)

- CSBT (4)

- Mobile Device (4)

- Mobile travel apps (4)

- OTAs (4)

- Static databases (4)

- Tour Companies (4)

- Travel Policy (4)

- Travel booking systems (4)

- Travel suppliers (4)

- back office automation (4)

- corporate self booking tool (4)

- millennial travelers (4)

- online travel (4)

- responsive travel website (4)

- technology (4)

- travel website conversion (4)

- 2016 (3)

- Content mapping (3)

- Databases (3)

- Demographics (3)

- Food and Adventure Tourism (3)

- Mobile Apps (3)

- Travel Distribution Channels (3)

- Travel Management Software (3)

- Travel customers (3)

- Travel history (3)

- anniversary (3)

- automated processes (3)

- content matching (3)

- global travel industry (3)

- social media (3)

- travel agency workflow (3)

- travel back office (3)

- travel marketing (3)

- travel process automation (3)

- AI in travel (2)

- Advanced Booking Systems (2)

- B2B Travel Resellers (2)

- Bleisure (2)

- Branding (2)

- Business Process Automation (2)

- Business Travelers (2)

- Customer engagement (2)

- Financial Reporting (2)

- Food Tourism (2)

- Inbound Marketing (2)

- Infographic (2)

- Leisure Travel (2)

- Saas (2)

- Templates (2)

- Travel Costs (2)

- Travel bookings (2)

- Travel start-up (2)

- Travel website abandonment (2)

- WTM 2016 (2)

- abandoned travel bookings (2)

- engagement marketing (2)

- internet booking engine (2)

- millennial traveler (2)

- new travel company (2)

- office (2)

- online reputation management (2)

- online travel reviews (2)

- reporting (2)

- software (2)

- start-up tips (2)

- travel agency management (2)

- travel agency website (2)

- travel experience (2)

- travel mobile app (2)

- travel packages (2)

- travel reservation system (2)

- travel system (2)

- travelers (2)

- web-based travel erp (2)

- 2020 (1)

- 360 Customer View (1)

- Advanced Accommodation Contract Management (1)

- Adventure travelers (1)

- Apps (1)

- B2B Reseller (1)

- B2B Resellers (1)

- B2C (1)

- BI Reporting (1)

- Budget traveler (1)

- Cancellations (1)

- Chat (1)

- Chinese millennial (1)

- Cloud (1)

- Cognitive computing (1)

- Comparison shopping (1)

- Conference (1)

- Contact matching (1)

- Content (1)

- Cruise (1)

- Culinary traveler (1)

- Customer relations (1)

- Digital Innovation (1)

- Digital Natives (1)

- Documents (1)

- Emerging market travelers (1)

- Emerging markets (1)

- Errors (1)

- Experimental travel (1)

- Financial Dashboard (1)

- Import rates (1)

- Instant messaging (1)

- Integrate with Accounting Software (1)

- Internet (1)

- Luxury traveler (1)

- Mobile Transaction (1)

- Mobile payments (1)

- NDC distribution (1)

- Operational Reporting (1)

- Reseller networks (1)

- Resellers (1)

- Response (1)

- Subagents Network (1)

- TINA Academy (1)

- TTE (1)

- Travel Reseller Network (1)

- Travel Revenue Management (1)

- Travel booking problems (1)

- Travel finance reporting (1)

- Travel stats (1)

- WTM (1)

- abandonment (1)

- accomodations (1)

- advanced reporting (1)

- airline direct connect technology (1)

- ancillary services (1)

- cloud computing (1)

- collection (1)

- collection challenges (1)

- common data model (1)

- conversion rates (1)

- corporate mobile app (1)

- cost control (1)

- credo ventures capital invests in dcs plus (1)

- customer reviews (1)

- data analysis (1)

- dcs plus credo investment (1)

- dcs plus credo ventures (1)

- deloitte technology fast 500 EMEA (1)

- digital transformation (1)

- e-invoicing KSA (1)

- email marketing (1)

- email marketing for OTAs (1)

- erp e-invoicing (1)

- lost travel bookings (1)

- modern travel agencies (1)

- networks (1)

- new features (1)

- offers (1)

- online customer review (1)

- online reputation (1)

- online travel agencies (1)

- risk management (1)

- sales (1)

- senior travelers (1)

- shopping baskets (1)

- shopping carts (1)

- social network (1)

- standardized processes (1)

- static content (1)

- travel SaaS (1)

- travel account services (1)

- travel agency customers (1)

- travel agency profitability (1)

- travel analytics (1)

- travel blog (1)

- travel planning (1)

- travel reviews (1)

- travel shopping carts (1)

- travel software for agencies (1)

- travel software system (1)

- travel technology europe (1)

- travlist smart mobile app (1)

- trend (1)

- trusted adviser (1)

- trusted advisor (1)

- upsell functionality (1)

- vouchers (1)

- website traffic (1)

- zatca (1)

Subscribe by email

You May Also Like

These Related Stories

Are Needless Expenses Killing your Travel Company?

What Advanced Reporting Means to a Travel Agency

No Comments Yet

Let us know what you think